1 c 8.3 dismissal of an employee

In today’s material we will look in detail at how a software product called “8.3” edition “3.0” can correctly formalize the dismissal of an enterprise employee.

In order to reflect this operation in the above-mentioned software product, there is a document named “Release”. This document makes it possible not only to record the fact of termination (termination) of an employment contract, but also to prepare the necessary order in accordance with the form approved for this purpose, but also to calculate all necessary accruals.

In order to formalize the final calculation of compensation with the employee, there are the following types of accruals:

Calculation of wages due for that part of the month that the employee worked before the day of dismissal;

Calculation of personal income tax and insurance premiums;

Calculation of severance pay. This happens when the dismissal falls under a case established by law.

The document also allows you to:

During the inter-settlement period, print a statement for the payment of accrued amounts during the inter-settlement period;

Retain the days given in advance;

Now let's move on to the formation of the document itself. Go to the menu called “Personnel”, then to the item called “Hiring, transfers, dismissal”. In the window with the list of documentation, press the key named “Create” and select “Release” from the drop-down list.

Now proceed directly to the formation of the document itself. To begin, select the company and employee you want to release. Then enter the month. All other calculations made by this document will be registered in this month.

How to set up the calculation of compensation in case of dismissal?

First, we would like to draw your attention to the fact that if you have document recalculation set in automatic mode in your software product (which is set by default), then immediately after entering the month, data calculation will begin. And this will happen after introducing or changing each of the significant indicators. From time to time this is annoying; recalculation can sometimes take several seconds.

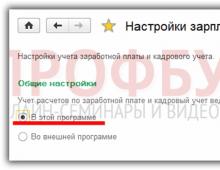

Therefore, if desired, this setting can be changed. This is done as follows: you need to go to the menu named “Settings”, then to the “Payroll calculation” item and uncheck the necessary corresponding box:

Now, when entering or changing information, the arrow key located on the right will be highlighted in yellow, and for calculation purposes it is advisable to press it:

We return to filling out the document in the software product “1C Salary and Personnel Management 8.3”.

Carrying out dismissal and settlement

First, indicate the date of dismissal of the employee, whether compensation for the main vacation is necessary, or whether it is necessary to withhold the days given in advance. If necessary, enter the number of days of severance pay. The basic information for the calculation has been entered. Let's see what happened:

It can be seen that all indicators have been calculated. Now there is a need to check them. You will immediately see a warning message titled “Earnings data is incomplete.” To solve this problem, click on the green marker called “Change data”, which is located next to the field. Here's what we'll see:

In this material we will not analyze what information is missing in this case, especially since it is not working, but in real conditions this possibility is very useful.

In general, our calculation of compensation in case of dismissal in a software product called “1C ZUP 3.0” is completed.

Now go to the tab named “Accruals and Deductions”:

This tab has the following 6 subtabs:

Benefits;

Accrual;

On the tab named “Additional”, as a comment, it is possible to enter the details of the document indicating the grounds for dismissal of the employee.

Now the document needs to be processed. Once completed, the following documents become available for printing.

To successfully enter the Dismissal document, we will check the settings of the 1C 8.3 program to avoid errors in the future. To do this, on the Salary and Personnel tab, in the Directories and Settings section, select the Salary Settings item:

Please note that in the General settings section, Payroll and personnel records are maintained, there should be an item In this program:

Let's look at how to fire an employee using different options for setting up personnel records in 1C 8.3 Accounting 3.0.

How to fire an employee using simplified personnel records

If the Simplified view is set, then in the system in 1C 8.3 Accounting all personnel documents will not be used. Additional fields Admission Date and Dismissal Date will appear in the employee’s card:

In order to dismiss an employee, just enter the date of dismissal in the appropriate field and save the changes:

To prevent a dismissed employee from being reflected in the general list with working employees, you need to check the Do not appear in lists box. All transactions for the employee have been completed.

From the employee’s card, using the Print button, you can print a dismissal order:

The printed form of the dismissal order will not be completely filled out, since the database in 1C 8.3 Accounting does not have enough data, for example, the document number. This data must be entered manually by enabling the ability to edit the form:

How to carry out dismissal in 1C 8.3 with full personnel records

If the Full type of personnel records is installed, then in the 1C Accounting 8.3 system it becomes possible to enter personnel documents.

To register the fact of an employee’s dismissal from an organization, we use the Dismissal document, which is located on the Salary and Personnel tab – section Personnel records – Dismissals:

In the document we indicate:

- Full name of the employee;

- Article of the Labor Code of the Russian Federation;

- In the document date and dismissal date field, the current date is entered by default, which can be replaced with the desired one;

- In the Manager and Position field, the data comes from the Signatures of responsible persons register (Organization - Signatures section);

- In the Grounds field, indicate the reason for dismissal (employee statement, medical report, etc.):

You can save the document without posting it by clicking the Write button, in which case the order number will be registered in 1C 8.3 Accounting 3.0, but information about the dismissal will not be recorded, that is, the employee will be considered working:

After filling in the appropriate fields, click the Submit button. The document is completed and posted.

From the document form, using the Print command, you can print a printed form of the dismissal order T-8:

In the second option, the printed form of the document opens directly in Word:

For the convenience and time saving of the user of 1C 8.3 Accounting, in the form of a document, by clicking the Create on the basis button, you can generate the necessary documents:

- 2-NDFL for employees;

- Outgoing certificate for calculating benefits:

You can find out all the necessary information about filling out personnel orders, hiring and dismissing employees, as well as transferring employees to 1C 8.3 Accounting in the module. For more information about the course, watch the following video:

Please rate this article:

Formalize the dismissal of an employee.

To reflect this operation in the program, there is a document “Dismissal”. This document allows you not only to record the fact of termination (termination) of the employment contract and prepare the corresponding order in the form approved for this, but also to calculate all the necessary charges.

In order to issue a final one, the following types of charges are provided:

- calculation of the due salary for that part of the month that he worked before the day of dismissal;

- (if the dismissal falls under a case established by law);

- calculation of insurance premiums and personal income tax.

The document also allows:

- print a statement for the payment of accrued amounts during the inter-settlement period;

- calculate compensation for the days that the employee has left from the main vacation and additional vacations (if they are provided for in the organization);

- keep the days given in advance.

Let's move on to creating the document. Go to the “Personnel” menu, “Hiring, transfers, dismissals” item. In the window with a list of documents, click the “Create” button and select “Dismissal” from the drop-down list.

Let's move on to creating the document. First of all, we choose the organization and the employee we will fire. Then indicate the month. All further calculations made by this document will be recorded this month.

Setting up the calculation of compensation upon dismissal in 1C

I would like to immediately draw your attention and make a small digression to the fact that if you have automatic document recalculation set in your 1C 8.3 settings (and this is set by default), immediately after entering the month, data calculation will begin. And this will happen after entering or changing each significant indicator. Sometimes this is noticeably annoying; recalculation can sometimes take several seconds.

Get 267 video lessons on 1C for free:

Therefore, this setting can be changed if desired. This is done like this: go to the “Settings” menu, the “Payroll calculation” item, and uncheck the corresponding box:

Now, when entering or changing data, the arrow button (on the right) will be highlighted in yellow, and to calculate (recalculate) you should press it:

Let's return to filling out the document in 1C Salary and personnel management 8.3.

Carrying out dismissal and settlement

We indicate the date of dismissal of the employee, whether compensation for the main vacation is required or whether the days given in advance need to be withheld, and if necessary, enter the number of days of severance pay. We have entered the basic data for the calculation, let’s see what happens:

We see that all indicators have been calculated and we can check them. The warning message “Earnings data is incomplete” immediately catches your eye. To deal with this problem, you need to click on the green “Change data” marker next to the field. Here's what we'll see:

Within the framework of this article, I will not analyze what data is missing here, especially since this is not a working database, but in real conditions this feature is very useful.

In general, our calculation of compensation upon dismissal in 1C ZUP 3.1 is completed.

To successfully enter the Dismissal document, we will check the settings of the 1C 8.3 program to avoid errors in the future. To do this, on the Salary and Personnel tab, in the Directories and Settings section, select the Salary Settings item:

Please note that in the General settings section, Payroll and personnel records are maintained, there should be an item In this program:

Let's look at how to fire an employee using different options for setting up personnel records in 1C 8.3 Accounting 3.0.

How to fire an employee using simplified personnel records

If the Simplified view is set, then in the system in 1C 8.3 Accounting all personnel documents will not be used. Additional fields Admission Date and Dismissal Date will appear in the employee’s card:

In order to dismiss an employee, just enter the date of dismissal in the appropriate field and save the changes:

To prevent a dismissed employee from being reflected in the general list with working employees, you need to check the Do not appear in lists box. All transactions for the employee have been completed.

From the employee’s card, using the Print button, you can print a dismissal order:

The printed form of the dismissal order will not be completely filled out, since the database in 1C 8.3 Accounting does not have enough data, for example, the document number. This data must be entered manually by enabling the ability to edit the form:

How to carry out dismissal in 1C 8.3 with full personnel records

If the Full type of personnel records is installed, then in the 1C Accounting 8.3 system it becomes possible to enter personnel documents.

To register the fact of an employee’s dismissal from an organization, we use the Dismissal document, which is located on the Salary and Personnel tab – section Personnel records – Dismissals:

In the document we indicate:

- Full name of the employee;

- Article of the Labor Code of the Russian Federation;

- In the document date and dismissal date field, the current date is entered by default, which can be replaced with the desired one;

- In the Manager and Position field, the data comes from the Signatures of responsible persons register (Organization - Signatures section);

- In the Grounds field, indicate the reason for dismissal (employee statement, medical report, etc.):

You can save the document without posting it by clicking the Write button, in which case the order number will be registered in 1C 8.3 Accounting 3.0, but information about the dismissal will not be recorded, that is, the employee will be considered working:

After filling in the appropriate fields, click the Submit button. The document is completed and posted.

From the document form, using the Print command, you can print a printed form of the dismissal order T-8:

In the second option, the printed form of the document opens directly in Word:

For the convenience and time saving of the user of 1C 8.3 Accounting, in the form of a document, by clicking the Create on the basis button, you can generate the necessary documents:

- 2-NDFL for employees;

- Outgoing certificate for calculating benefits:

You can find out all the necessary information about filling out personnel orders, hiring and dismissing employees, as well as transferring employees to 1C 8.3 Accounting in the module. For more information about the course, watch the following video:

Please rate this article:

Typical 1C configuration: ZUP 8 has functionality that allows you to carry out the labor-intensive procedure of dismissing an employee and calculating compensation in several steps.

Drawing up a dismissal order

The procedure for dismissing an employee begins with the preparation of personnel documents, namely with a dismissal order. This can be done in the “Human Resources” section by selecting the “Dismissal from the organization” document. By clicking the “Selection” button, you must select the last name of the employee who is being dismissed, then indicate the date of dismissal (usually two weeks after notifying the employer), as well as the article of the Labor Code in accordance with which the employee is being dismissed (for example, at his own request, by agreement sides, etc.). Program 1C: ZUP 8 in this case, it first checks whether an order to dismiss the employee has previously been issued. If yes, then the user receives an error message. If everything is in order, then the program automatically fills in the fields “Days”, “Working year”, “Compensation”. After this, you need to post and save the document by clicking the “OK” button. You can print the dismissal order if you go to the “Print” menu, section “Form T-8”.

Payment to an employee upon dismissal

After the order is issued, it is necessary to make a settlement with the employee. This is done using the document “Calculation upon dismissal of an employee of an organization”, which is located in the “Salary calculation for an organization” menu, section “Primary documents”.

Condition Tab

On the “Condition” tab of the “Calculation upon dismissal of an employee of organizations” document, the name of the organization, the date of the document and the month of calculation are automatically filled in. After this, the accountant needs to indicate the employee by entering the first letters of his last name, after which the program will automatically substitute the full last name and initials. In the “Dismissal Order” field, you must select an order for the enterprise to dismiss a specific employee. As a result of these two actions, all other fields will be automatically filled in: “Date of dismissal”, “Period of work”, “Days of compensation”.

Average earnings calculation tab

The “Calculation of average earnings” tab displays data on the employee’s earnings, which are used in the calculation of average daily or average hourly earnings. The calculation period should be specified as 12 months before dismissal. By selecting the “Calculate average earnings” command in the “Calculate” command panel menu, the user sees how the program automatically performs all calculations. If there is no data for the specified period, then the earnings data must be entered manually according to the types indicated in the lines.

The “Payment” tab displays the amounts to be charged. You can automatically calculate these amounts by clicking the “Calculate” button on the command panel. At the same time, the results of the automatic calculation can be manually edited if necessary.